More often than not, when one goes to pick up a loan, they know how much they are borrowing, what interest-rate the loan would bear, and how many EMIs they would have to pay.

To think of a debt arrangement where the principal amount is undefined, sounds uncanny. Well, such is the arrangement of an Income Share Agreement, or simply an ISA. In ISAs, the amount of debt you have to repay is dependent on the success of the product/service against which you are taking your loan.

Weird? Confusing? That is what makes ISAs so interesting!

Typically, in India, companies that offer their services under the ISA agreement are companies offering Coding Bootcamps. Popular names in the space are Masai School, Pesto Tech, and Newton School.

These schools are built on a simple funda (principle):

“If you are smart, we will make you smarter. We will make you rich, and then you pay us after”.

Applicants at such programs generally have to go through a certain level of screening to get into a particular training batch of these startups. For example, Pesto Tech has a highly selective screening process and selection rate of less than 1%.

Post applications, students go through a rigorous coding bootcamp for a period of 16 to 52 weeks, where they work on live projects, and are eventually placed at roles which match their training.

Ah! The Fees

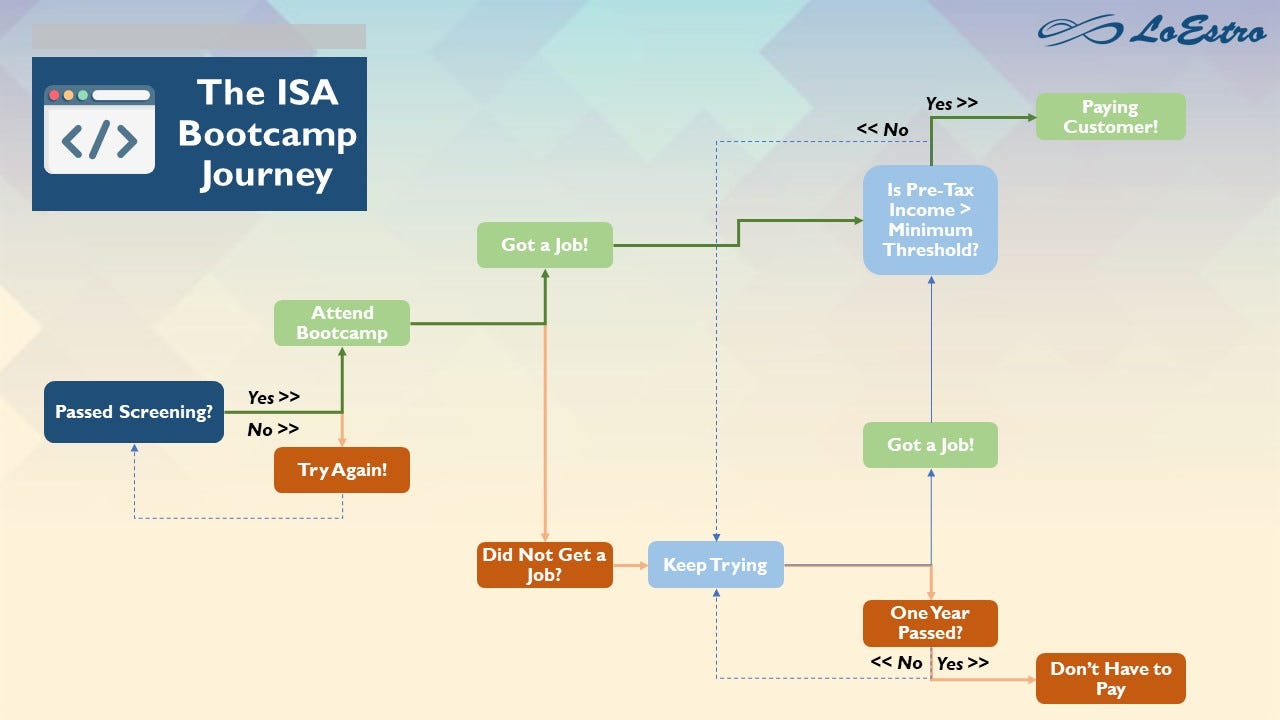

The ultimate exchange of money is dependent on four things: (1) minimum salary/minimum salary increase, (2) income share, (3) payment period, and (4) the payback cap

- Minimum Salary is the bottom threshold of pre-tax income, which must be met in order for the ISA to be triggered

- The percentage of income is the portion of post placement salary the student will pay to the company every month as a part of the agreement (Masai School does it at 15%)

- Payment period is the number of months for which the payment is paid, i.e., if payment period is 36 months, then 36 installments have to be paid

- The payback cap is the cumulative sum beyond which the company won’t charge anymore fees, even if this maximum limit is achieved within the first month of the payment period

The History of ISAs

- 1955: Milton Friedman proposes the idea of an equity investment in an individual, allowing investors to buy “shares” in future earnings

- 1970s: Off Friedman’s idea, Yale University creates an ISA program where each participant continues making payments until the collective tuition fund (of all students) is returned. Implying that students who placed higher-paying jobs would end up paying disproportionately more than than students with lower income jobs

- 2012: App Academy was the first coding boot-camp company that introduced ISAs, but never really took off

- 2016: Lambda School was founded, and introduced its nine-month coding program. Instead of paying tuition, students attend Lambda School for free, then pay 17% of their income for the first two years they’re employed (as long as making more than $50,000). Total payment is capped at $30,000, and students have the option of paying $20,000 upfront.

Lambda School really took off, and here’s why. Austen Allred, Lambda School’s CEO, really went off on Twitter and maintained an active communication and engagement with engineers globally on Twitter, including Indians. Simpl and Freshworks were a couple of companies who hired Lambda graduates in India.

And it started garnering VC attention.

Can ISAs be Successful in India?

To truly understand if ISAs suit the Indian market, it is imperative to understand why Lambda School was successful apart from its solid communication strategies in the US. And it can be answered in three simple words; Massive Student Debt.

The US has a significantly different culture, when compared to India. The US thrives on the idea of individualism and financial independence, and therefore students fund their education right from their undergraduate degrees, which has amounted to a large pile of cumulative student debt in the US.

How large of a pile? The Federal Bank estimated total student debt to be at $1.7 trillion (as of September 2020).

On the contrary, India has a much more collective value system. Parents, who have the resources (even if barely), are willing to pay for their child’s whole educational journey, starting from nursery education to their post-graduate degrees. Student loans are a fairly uncomfortable idea. Education is driven by the attainment of jobs, rather than other (also important?) goals.

And there is certainly a gap in that still remains in the Indian Engineering Education system (Source):

- About 1.5 million engineering graduates receive their degrees annually

- ~60% of engineering graduates say industry applications of concepts are not discussed in classes

- Of 1.5 million annual engineering graduates, employable percentages in new age skills such as mobile development, AI, and web development range from 1.2% to 5.3% only

- Whereas, 44% of all engineering graduates want to have software development roles

- Initial salary aspirations of computer engineering graduates stand at a median of INR 416,000

On the other hand, because India’s engineering graduates aren’t skilled enough, companies have to spend a lot of money training them. In 2019, Infosys COO Ravi Kumar said that the company spends about Rs 14 lakh on the training of each student, after which it takes them 12 weeks to become productive. While this number might be overstated, hiring and training employees still is a big cost for IT firms.

However, startups cannot afford to sit and train people on the fundamentals of programming, and therefore have to hire experienced engineers, often costing them huge cash or equity at the beginning of their journeys.

Enter: Coding Bootcamps

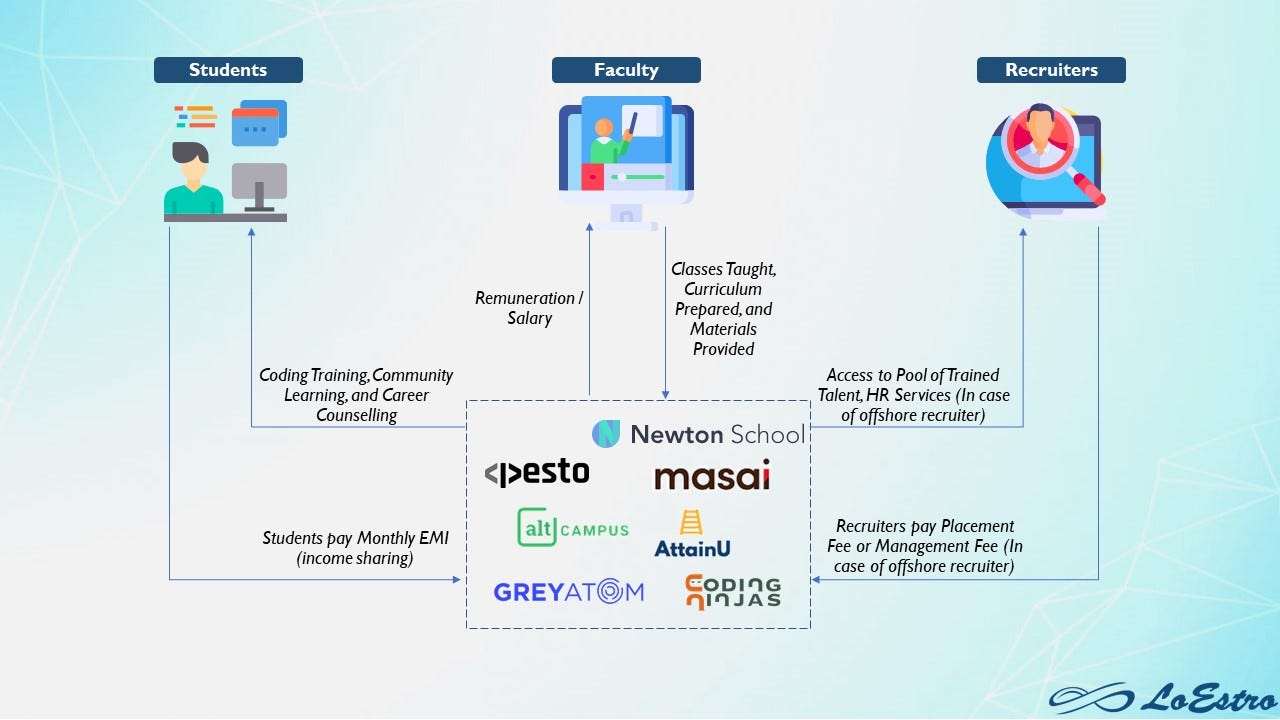

Companies offering coding bootcamps under ISAs gear their solutions for three parties: (i) Students, (ii) Recruiters, and (iii) Faculty. The visual below describes the inter-entity relationship perfectly:

One of the most important, if not the most important, exchanges that happens in this entire relationship is when the student gets placed with a recruiter. This is the primary utility driver for students, and the revenue maker for the company. Students who leave their jobs to take these bootcamps (although can now be curtailed through evening only online classes, albeit longer courses), make up for their opportunity cost by the increase in take-home pay.

A lot of criticism that ISAs face in the market is that the time given up during attending these courses can be used to instead focus on your current role, take up some regular MooC, and try to work your way up the ranks/switch laterally. This could save not only time, but more importantly all the money you would have to give up as a part of your ISA.

So in this backdrop, let’s look at two things:

- How much do engineers make in India based on experience?

- How much of a salary jump/increase can these ISA companies offer?

This is the journey of an average full stack developer’s salary in India as their experience increases. Full stack developers are those who can handle all the work that a client wants them to do on web-application such as front-end, back-end, servers, and databases. Average salary if you have anywhere between 1–4 years of experience is about INR 5.5 lakhs.

Please remember, that the above graph is for a full stack web developer. The average software engineer salary is much lower at about INR 4.6 lakhs if you have 1–4 years of experience, graph below:

On that note, let us now look at what some of these coding bootcamps have to offer us (exclusively looking at companies that offer ISA programs):

- Pesto Tech: The average salary of Pesto’s Residency Program graduates is INR 31 LPA (the residency program was operated before the pandemic). Their typical software engineer has 2 to 5 years of work experience, and the company’s ISA is triggered only when a student makes 2x of their previous salary

- Masai School: Average salary of about 200+ students has been about INR 6.8 LPA. Fun fact: About 50% of the company’s student base does not have a computer science-background. ISA gets triggered when annual pre-tax income is a minimum of INR 5 LPA

- Newton School: The company’s primary bootcamp is geared towards graduates from ANY field, and offers a package anywhere between INR 5–40 LPA, and claims to give experienced students a jump of 2–3x in their salary. ISA gets triggered at minimum annual package of INR 5 LPA

There is a significant level of variance between Pesto and the other two companies (Masai and Newton), when it comes to their average packages. Here, it is important to note that all these companies have their fees capped at different levels. For example, Masai has it capped at INR 3 LPA and Newton has it at INR 2.5 LPA. What about Pesto? Well, Pesto has it capped at INR 20 LPA.

Maybe in this case a student needs to ask themselves if the “Juice is worth the Squeeze”

Also, Pesto is able to place their students at significantly higher packages because their recruiting partners are mostly American companies, who offer salaries at a discount to what they would software engineers in the US. Hence, they end up paying their remote Indian employees about 30–40K USD for a full-time role.

With average packages of INR 6LPA, regular batches, and a healthy placement rate, this business can seem very investible, and VCs agree.

Key investment merits of these businesses are:

- Huge Market Opportunity due to the sheer number of engineering graduates seeking jobs in a market where demand for skilled professionals with full-stack development and data science is extremely high

- Two-Fold Revenue Model: The company generates revenue from both the demand and the supply side; (i) Monthly fee from passing cohorts (each cohort leads to contractual cash flows for next 36 months). (ii) Hiring Partner-Management fees: On a per-hire basis

- High Gross Margins: With most of the courses now being held online, there is not a lot of expenses that go into delivering the learning online. Pesto claims to operate at GM levels of 80–85%

- High LTV: A customer that receives training for 16–52 weeks, ends up becoming a paying customer for the next 36 months, with LTV going as high as INR 20 LPA

- Lower CAC: The demand for higher paying jobs leads to companies seeing a high number of applications in this space. With each passing cohort, more and more word goes out about the success of joining such bootcamps, leading to a viral word-of-mouth effect. For example, for its first batch, Pesto received only 300 applications. But once this cohort passed and the word got out that they all received job offers with an average salary of USD 30K a year, applications skyrocketed. The next batch saw 20K applicants

Having said that, the industry can face working capital challenges due to the high number of debtors it holds in the form of graduating cohorts. Since the earnings from a student is spread out over 36 months, companies may have to take short-term loans from institutions to fund working capital requirements.

Another shadow that looms over the space comes from the ambiguity in not knowing how effectively these companies are going to be able to scale. As they start operating more and more batches, placement rates can be expected to go down, as there may simply not be as many hiring partnerships available to go with the rising number of passing cohorts. And as with scaling, average placement packages also can be expected to come down over time.

One Way to Fund Working Capital — Securitization of ISAs. What?

In December 2019, Lambda School partnered with Edly, a digital marketplace that helps schools sell income-sharing agreements (ISAs) to accredited investors. The arrangement allowed Lambda to receive money from the ISAs upfront, rather than waiting for students to find jobs.

These ISAs were sold to investors by promising them a minimum of 13% return on their investment.

Naturally, as soon as word got out, Lambda received a lot of slack for it, and rightly so.

Now What?

We are not going to make sweeping statements about whether ISAs in education financing will work or not, or how companies should turn themselves into placement agencies.

So far, companies have shown brilliant results and customers seem to be fairly satisfied. There are a few key questions looming over the industry, and we are keenly waiting to see how the players in the market come and tackle these questions.

Honestly, it would be amazing if this model could succeed with scale. The sheer number of students who could get access to world-class technical education sounds brilliant. On top of that, individuals could end up leading way more successful and enriching lives based on the salary increases they see. On the other hand, poorly handled decisions could lead to students being trapped in crushing financial obligations for three years, a fairly long time at young age of 22–26.

We could also see this model being adapted in areas such as digital marketing, finance, and business strategy. The deciding factors might end up being the salary jumps and placement quality that companies would have to offer to candidates that opt in.

At the end, the only rule you have to follow, is this.

Watch this space for more on EdTech, Education, and everything in between.