Between March 14th and March 31st, EdTech companies in India raised almost $500 million, with Byju’s raising about $460 million making it India’s second highest valued start-up (just behind Paytm). We saw companies in Higher Education (Degree/Financing) and Upskilling/Reskilling get funded by global investors.

Who Got a Slice?

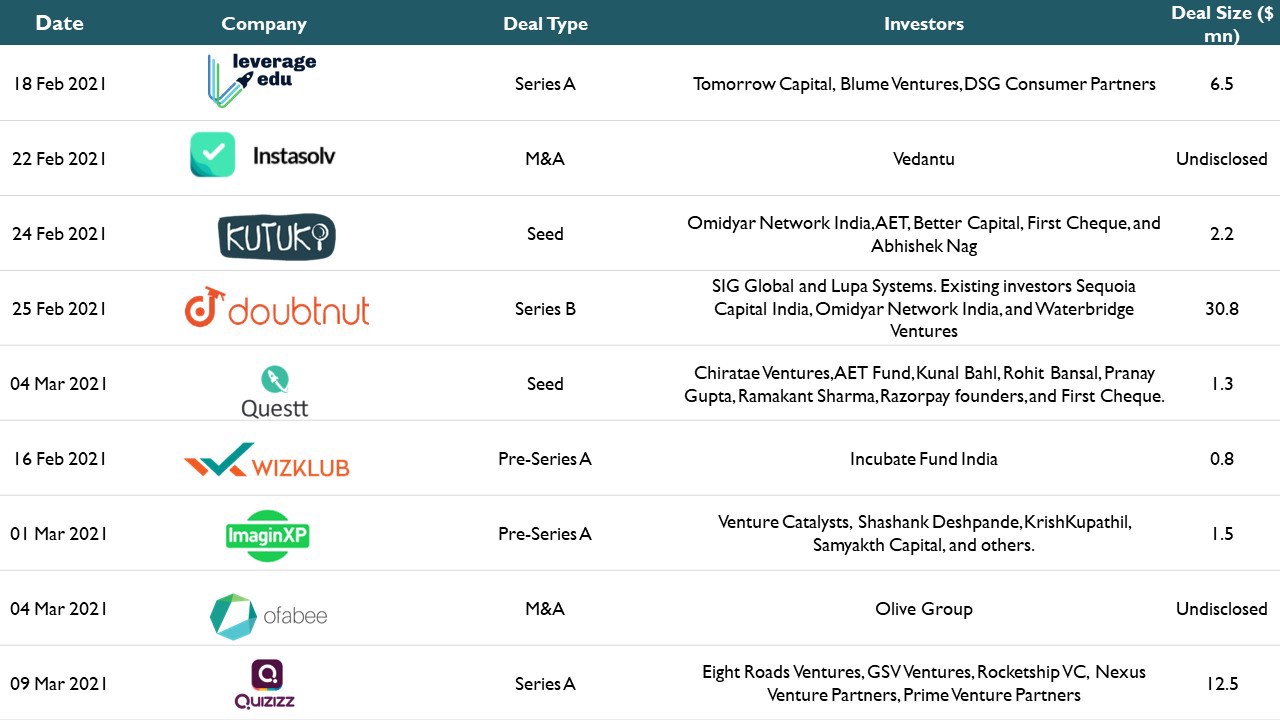

- Leap (Series B, $17 million): Founded in 2019, Leap offers counselling visa, and education loan services for international students. Leap has an online community that helps students evaluate career options, network with seniors and shortlist the best courses. Jungle Ventures led the round and saw participation from Sequoia Capital India and Owl Ventures.

Leap seeks to be a one-stop solution for all students who seek to go abroad for their higher education. Right from counselling to financing, Leap is integrating across the whole value chain. We have seen a lot of start-ups in EdTech starting to provide end-to-end solutions, with upGrad being one of the biggest names in the space. - iNurture (Series C, $10 million): iNurture is a company that provides industry-centric degree programmes in partnership with recognized universities in India. Kimera Ltd, a Dubai-based family office, led the bridge financing round.

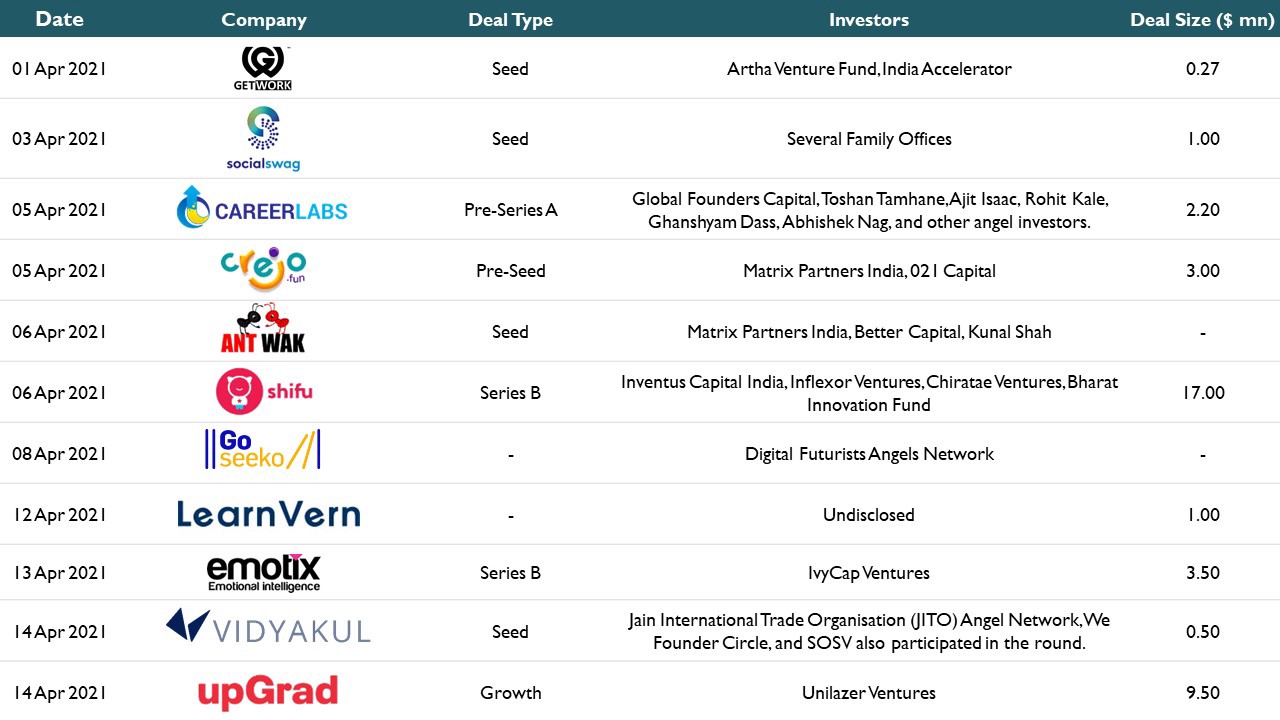

We saw a similar transaction happen a couple of weeks ago with ImaginXP which also provides graduate and post-graduate programmes in collaboration with Indian universities. iNurture had acquired Krackin in 2018, which allowed it to display/have a career-centric approad for its customers along with delivering new age programs. - SkilloVilla (Seed, $300K): Founded in 2020, SkilloVilla is an upskilling platform which offers courses in coding and placement services. Titan Capital led the round with participation from Haresh Chawla, Miten Sampat, Aakrit Vaish, and Varun Alagh.

India has consistently had an abundance of engineers graduating annually, but employability of such engineers has remained low through the years. About 80% of engineers are said to be unemployable, with less than 5% actually being capable of new-age coding/developing roles. Skillovilla has its career track programme priced at about INR 50k, which is relatively inexpensive compared to the company we talk about next. But is the price the only problem for Indian students? Let’s find out. - Masai School (Series A, $5 million): Masai School is a coding bootcamp that trains tech aspirants in full-stack, web, and android development. The programme works on an ISA agreement and students pay up to 15% of their monthly income until they pay back INR 3 lakhs. The Series A funding round was led by Omidyar Network India with participation from existing investors Unitus Ventures, India Quotient and AngelList India.

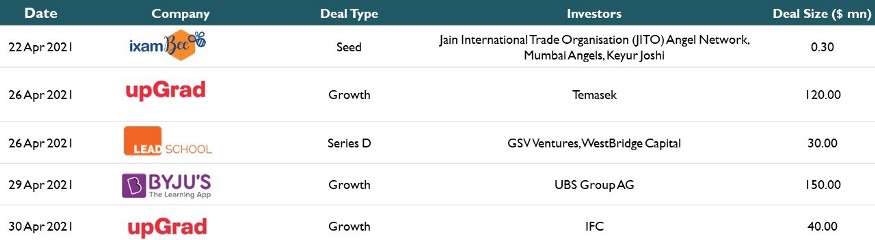

ISAs have been around for a while. There is nothing new about them really. Students sign up for a programme, get trained, placed, and then pay part of their monthly income as a fee to the company for a certain amount of time till the company recoups the fees. However, while a lot of companies may be inclusive with their pricing of the product, the biggest problem may be that students lack the infrastructure to learn in the first place. This is where Masai School may be solving a problem by also providing monetary support to top performers who could use the money to either invest in a laptop, a broadband connection, or to move out of their village for a better learning experience. - Byju’s (Series F, $460 million): Byju’s is India’s biggest EdTech startup that develops personalized learning programs for K-12 students. Byju’s created a K-12 learning app which offers learning programmes for students in classes 4–12 (K-12) and competitive exams like JEE, NEET, CAT, IAS, GRE and GMAT. The funding round valued BYJU’S at $13 Bn and was led by MC Global Edtech Investment Holdings with participation from B Capital, Tiga Investments, TCDS India LP, Arison Holdings, XN Exponent Holdings, Baron Emerging Market Fund and Baron Global Advantage Fund.

Byju’s has clearly maintained it is going to be the behemoth in the Indian EdTech space and maybe even the Indian start-up space in general, being the second highest valued startup in the country now. It is establishing itself as the one and only choice for parents in the K-12 space in India. However, Byju’s is now going global. With the fresh funds, the company seeks to make a few acquisitions, including what may be a $300 million acquisition of US reading platform Epic. Clearly, there is a pattern here. Byju’s is making smaller number of large acquisitions, while Unacademy is making larger number of small acquisitions (read more here). - Uable (Pre-Series A, $3.5 million): Uable offers real-life role-based programmes to empower children between 13 and 18 years of age to explore different domains at an early age and develop future-ready skills for roles in science & technology, art and design, programming and tech, and more. The round was led by JAFCO Asia and Chiratae Ventures. Existing investor 3one4 Capital also participated in the round.

Globally, companies which received funding included (i) Securly (Student Security), (ii) Dawrat (K-12 Online Learning), (iii) Acktec Technologies (Learning Management Systems), (iv) Lalilo (Early Education), (v) Holberton (Higher Education), and Abwaab (K-12).

Let Us Know What You Think?

- What do you think about companies integrating across whole value chains and becoming a one-stop solution? How do you think this affects the market?

- Do you think university brands matter when people go to ImaginXP or iNurture affiliated universities or will the availability of new-age courses drive the growth of these programs?

- Are ISA based companies actually staffing companies more than they are training companies? For students, is having to pay 15% of your income for 12–36 months worth the comfort of not having to pay cash upfront? (Most ISA companies have a fee-premium of 2x-3x when it comes to prepaid courses vs ISA courses)

Watch this space for more on Education, EdTech, and everything in between.

Visit our publication here to read more!