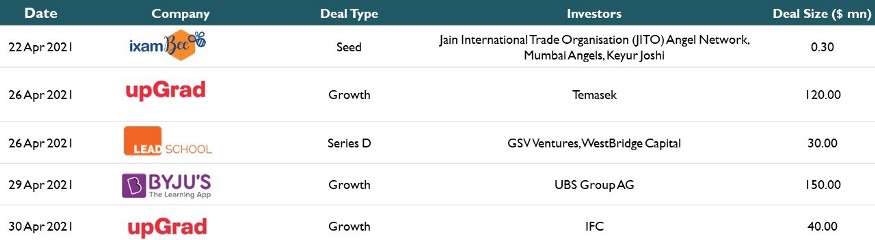

Between April 18, 2021 and May 02, 2021, we saw four companies in the Indian EdTech space getting funded. Byju’s and upGrad got majority of the investments, with EdTech collectively receiving about $340.3 million. Themes that got investor validation were K-12, Higher Education, and Test-Prep.

Who Got a Slice?

- ixamBee (Seed, $300K): The company provides technology-based learning solutions for competitive exams by offering learning material like mock tests, online test series, online practice tests, and speed tests series to help students prepare for banking and insurance exams, exams conducted by SSC, exams by Railways, teaching exams, and various government and other exams. Jain International Trade Organisation (JITO) Angel Network, Mumbai Angels, and Keyur Joshi invested in the round.

Prep material for Government Exams has come out as an opportunity for startup founders to enter the Tier-2/3/4 city markets. As many as 6.5 million students have used ixamBee’s material since 2017. However, monetisation could remain a challenge for a company like ixamBee; it is important to gauge where student traffic is coming from. If it is coming organically, due to high-quality content, then things are looking up. On the flipside, if traffic is driven from refusal to pay at a platform like say, Unacademy, then making same that customer pay for your product can be a challenge. - upGrad (Growth, $120 million): Founded in 2015, upGrad is India’s largest online higher education company providing programs in Data Science, Technology, Management and Law, to students, working professionals and enterprises. The company raised the funding from Temasek, making this the first external fund-raise by the EdTech major.

- LEAD School (Series D, $30 million): Founded in 2012 by Sumeet Mehta and Smita Deorah, LEAD School combines technology, curriculum, and pedagogy into an integrated system of teaching and learning to affordable private schools. The round was led by GSV Ventures along with WestBridge Capital, an existing investor.

Learning outcomes and English fluency are two of the largest problems that LEAD School solves leveraging its blended learning product, offering textbooks and digital learning solutions. It engages all stakeholders in education, including teachers, students, parents, and administration. As the world remains in this pandemic stricken reality, LEAD School could have its reality brightening as more schools look to onboard its platform, having been forced to adapt to this new digital world. - Byju’s (Growth, $150 million): BYJU’S is India’s biggest EdTech startup that develops personalized learning programs for K-12 students. Byju’s created a K-12 learning app which offers learning programmes for students in classes 4–12 (K-12) and competitive exams like JEE, NEET, CAT, IAS, GRE and GMAT. The company is raising about $150 million from UBS Group AG.

- upGrad (Growth, $40 million): Founded in 2015, upGrad is India’s largest online higher education company providing programs in Data Science, Technology, Management and Law, to students, working professionals and enterprises. IFC invested in the round.

Globally, companies which received funding included (i) CoLearn (K-12 learning), (ii) Class Technologies (K-12 learning), (iii) Fiveable (K-12 Learning), (iv) ExecOnline (Upskilling/Reskilling), (v) Databank Inc. (Test-Prep Solution), (vi) Kidato (K-12 Education), (vii) Honorlock (Online Proctoring), (viii) OpenClassrooms (Upskilling/Reskilling), and (ix) Thrive EdTech (K-12 learning).

Is Indian EdTech Going to be a Three-Headed Monster?

Byju’s $150 million funding from UBS values the company at roughly about $16.5 billion, making it the highest valued start-up in the country. All this, while the player is on a buyout tear, acquiring one company after another (Aakash, WhiteHat Jr, Scholr, LabInApp, etc.), and now is in talks to acquire GradeUp and Great Learning.

(Not so) Quietly watching from the sidelines, is India’s other EdTech unicorn, Unacademy, who also has rolled up quite a few brands under its name, such as Kreatryx, CodeChef, PrepLadder, Mastree, Coursavy, and Neostencil.

Byju’s products have historically been targeted towards 4 to 17 year old kids, with most of the focus being on K-12 prep. Where Byju’s ends its journey, is where the student rolls over to Unacademy and uses the platform for test-prep. Naturally, as Byju’s segwayed into test-prep, and Unacademy came into K-12, the Sequoia funded companies started seeing a bit of an overlap.

In the midst of all this chaos, Ronnie Screwvala bootstrapped upGrad to an annual revenue of INR 1,200 crore in FY21, having raised its first external funding from Temasek only a few days ago. Ronnie holds almost 60% of the equity in the company, the rest of the 40% split between investors and the co-founders. Having raised only two rounds of funding, the company is at an $850 million valuation mark, which maybe has upGrad just one funding round away from being a unicorn.

Have we been ignoring upGrad because it is not making as much funding noise?

Between 2015 and 2020, only 500K users had taken upGrad’s upskilling and reskilling programs, a number which crossed a million in only the period of nine months leading up to December 2020. This one million figure may seem bleak in comparison to Byju’s 5.5 million annual paid subscriptions. However, one important note here has to be ticket size. upGrad’s courses are generally undergraduate/postgraduate degree programs, which can cost anywhere between INR 50K to INR 450K, a lot of which are curated in partnerships with foreign universities.

There will always be an overlap between companies in their offerings. While the space is highly competitive, it is not a zero sum game. And customers will continue to have the liberty of choosing between one product or another. However, we may not see many small players trying to offer full-stack solutions the way Byju’s, Unacademy, and upGrad do. Simply because the gap between the small players and the large players is just massive.

Watch this space for more on EdTech, Education, and everything in between.