Stock Based M&A Transactions: Worth It?

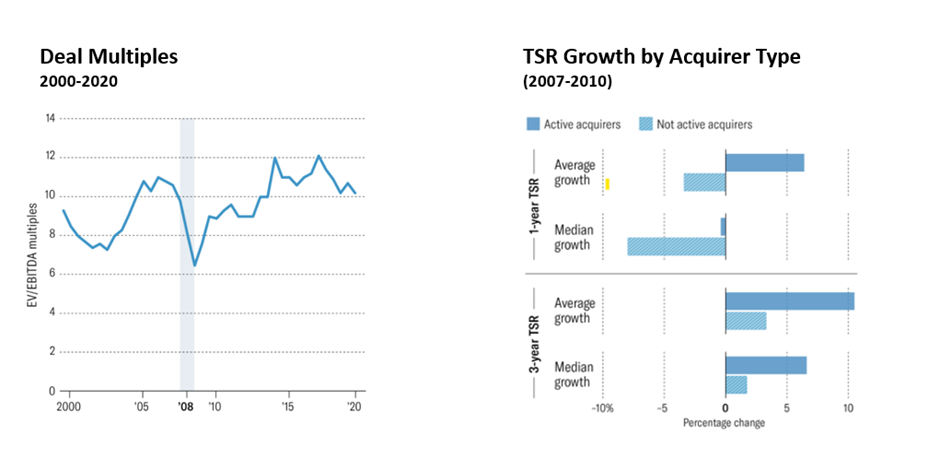

These are the best times for companies with capital to go shopping for the right assets. The funding winter has impacted the M&A demand supply curve — driving down valuations. On one side in the absence of strong primary capital, several quality businesses are seeking strategic acquirers (increase in supply) while on the other side, the absence of capital has led to reduction in the number of potential acquirers (decrease in demand). Historical data shows that companies with capital and who use acquisition as a strategic tool during slow-down have delivered outsized returns for their shareholders.

Increasingly buyers have started to use “stock” as a currency of choice for acquisition(s) — This has become more critical during current times when everyone is in a mode to conserve cash. With stock coming in play there are additional points to consider for both buyers and sellers:

Recent Notable Acquisitions in Education

Proportion of Cash vs Stock

Deals range from 100 percent cash to 100 percent share swap and somewhere in between — deals where there is mix of cash and stock. Several factors can influence the skew of the mix including:

Risk — Reward ratio: In pure cash deal, sellers cash out and are no longer responsible for the fate of the combined entity. The entire risk-reward ratio sits with the buyer. In 100 percent stock deal both parties share the risk-reward. Depending on the need for both parties to work together to exploit the synergies envisaged the mix can tilt toward cash or stock.Access to financing: Buyer’s access to financing plays a critical role in deciding the cash/ stock mix. In current markets where liquidity is scarce most deals tend to have a relatively higher stock component.Seller’s Cap Table: Most financial investors don’t prefer to swap their holding in one company with another company and prefer cash for their exit. Similarly, most buyers do not prefer unknown investors on their cap-table. Hence in most cases at least the portion of the seller’s company owned by investors are transacted on pure cash.Tax Implications: In a 100 percent stock deal, Court driven merger process can save on taxes. While in a cash deal, capital gain tax has to be paid by the seller. In partial or full stock deal, if a Court driven merger is not done then capital gain tax has to be paid on the entire consideration including that of the swap component.

Valuation

Valuation parameters become extremely critical in partial or full stock-based deals. One need not only establish the fair market value for the shares of the seller, but also the shares of the buyers to implement an unbiased swap ratio. This can become further complex depending on the specifics of each deal:

If the buyer and seller have different business lines and/or are of different sizes and growth profiles then it becomes difficult to arrive at the benchmarks to value each business. Otherwise, the companies could potentially use same valuation benchmarks.Given the market, listed buyer and seller make it easy to set the swap ratio. However, stocks can experience a lot of fluctuation in anticipation of the deal.In case of unlisted share swap, sellers will typically ask for price-protection/ anti-dilution or even return guarantee.

Liquidity

In the case of a share swap with a private company, shareholders of the seller eventually will have to rely on the buyer’s stakeholders for their liquidity. Most sellers in such a case would ask for similar, if not better liquidity rights as of the founders of the buyer. In some cases, they could ask for similar liquidity rights as the investor of the buyer. This could include:

Tag Along right with the founder / investor of the seller,Full liquidity in case of change of control of the seller,Buy-Back right under which the buyer is expected to buy back the shares,Put on the buyer and Drag along rights, if liquidity is not made available in defined time frame.

Depending on the portion of cash versus stock exit, this is one of the highly negotiated subject in most of the deals.

Seller Lock-in and Employment Matters:

In M&A situations where founders of the sellers are critical to run and grow the business, the transaction typically involves the founder lock-in for a varying period ranging from 2 years to 5 years. This allows the buyer to successfully integrate the businesses and to exploit the set of synergies anticipated. In case the seller founder breaks the lock-in, the buyers could claw-back a portion of the seller founder’s shares.

Tax Optimization

In stock swaps, partial or full, tax optimization and timing of tax incidence is a key consideration on transaction structure. Tax laws require the shareholders of the seller to pay full tax on the close of the transaction irrespective of the nature of the consideration — cash vs buyer’s stock. In cases where the founder has not received any cash consideration it becomes burdensome to pay taxes to the exchequer. Companies consider a few alternatives to optimize the quantum and timing of payment of taxes:

Court driven merger: Buyer can merge the sellers business onto itself through a Court (NCLT) driven process under which the sellers get new shares of the combined entity. There are no capital gains or any other tax applicable on such transactions. However, the merger process could be time and resource consuming.ESOPs vs Share swaps: In scenarios where the buyer is relatively large compared to the seller, and if majority of the transaction is in cash, companies have used ESOPs to compensate the founders of the seller instead of share swap. Under this structure the founders of the seller receive ESOPs of the buyer instead of swapping their shares. The business is transferred from the seller company to the buyer company via a business transfer or start/ stop agreement. The portion of the consideration which discharged by way of ESOPs, being contingent on the occurrence of certain underlying events, will become taxable only the time of exercising the ESOPs.Deferred Share swaps: In some scenarios the buyer only concludes the cash part of the transaction at closing with defined rights to buy the remaining shares of the seller in due course at an agreed price. The control of the company vests with the buyer but the overall shareholding gets transferred over a period of time

Watch this space for more on Education, EdTech, and everything in between.

Stock Based M&A Transactions: Worth It? was originally published in LoEstro Advisors on Medium, where people are continuing the conversation by highlighting and responding to this story.