An Overview on India’s Study Abroad Market: Opportunities and Trends

By FY2030, global study abroad spends are projected to be at $433Bn; with more than 8Mn+ international enrolments (Holoniq). Just a little over a decade back, India had 10,000 students studying abroad. As of 2022, the same was up to 750,000+ students, with India becoming the second largest supplier of students to universities abroad.

The fact that more and more Indian students are gearing up to study at international destinations is virtually uncontested. What’s interesting to see is the tremendous interest from low and medium tier universities in recruiting full-fee paying international students. Expensive tuition, resulting in reduced value perception of higher education in the US for instance has intensified competition. According to data from National Student Clearinghouse Research Center, US colleges and universities have seen a drop from 16.6Mn undergraduate enrolments in 2015 to less than 14.5Mn in 2019.

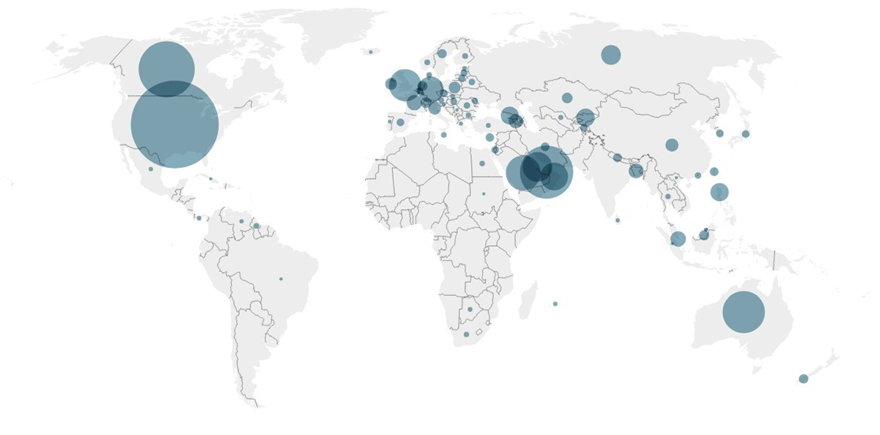

While US still remains as the leader in hosting Indian students, UK, Australia, and Canada also account for a lion’s share of this market. Outside of these, emerging destination like Ireland, Germany France in Europe and Malaysia, Singapore in Asia are fast catching up.

Figure: Estimated Distribution of Indian students studying across foreign destinations

To return to more cheery statistics, 2023 saw study-abroad companies put ed-tech back on the map. Leverage Edu raised a $40Mn round, AdmitKard and GradRight raised ~$6Mn each. (Well, funding winter?!). This is driven on the back of trying to get a share of the $85Bn pie that Indian students are expected to spend on overseas education.

Figure: Drivers of Student Demand:

Despite the growth, students need to navigate a cumbersome process starting from research, to applications, documentation and even financing. Students get guidance from a host of informal players (friends, family, seniors); through formal research (online portals, college fair) and professionals (counsellors, admissions consulting companies, financing marketplaces). This continues to be fragmented across the lifecycle; however, players are starting to take a more integrated approach in a bid to increase the customer lifetime value (more on this later).

Figure: Study Abroad Value Chain Matrix

The study abroad value chain is an interesting mix of organized players vs mom and pop setups, offline/ hybrid vs online-first businesses, specialized players vs those that are taking a more integrated approach. Let’s break this down one-by-one.

1. Career Discovery — This is a highly fragmented market; according to research conducted by RedSeer, friends/ family and professional counsellors emerge as the most popular modes of research for students going abroad.

Business Models are of two types:

● Non-scalable high-touch driven student counselling / career assessment services

● Low touch college discovery platforms that typically monetise through a combination of lead generation and digital marketing services offered to universities / other players

2. Admission Consulting — This is a fairly lucrative segment as companies attempt to monetise through larger university marketing budgets and charge a nominal / no fee to students for the services provided.

According to the State of the International Student Recruitment and Enrolment Field Survey, A key strategy for the majority of institutions (62%) is partnering with commission-based educational agencies to recruit international students. Over the years, universities marketing budgets have increased. Our survey among study abroad partners revealed an average commission of US$2,500–3,500 per student successfully placed.

This is neither a new category, nor one that ed-tech has created. IDP, The Chopra’s, Career Mosaic are among the many offline players that have existed through their network of agents and sub-agents. In recent years, we see tech-first players like Leverage Edu, AdmitKard, Leap Scholar use data & analytics to address information asymmetry in a bid to help students find the right program-university match.

Another sub-segment here where students typically get the most external help is test preparation — this allows for further monetisation.

Trend Spotting: Admission Consulting players are starting to add other service lines (eg. Fly Finance, Fly Homes by Leverage Edu) in a bid increase the customer lifetime value and become a full-stack offering

3. Financing Players — Total expense of an overseas degree can cost anywhere between INR 35 lakhs to 2 Cr. This space sees the dominance of large players primarily across two business models –

a. Marketplaces — Banks typically shied away from lending to this sector, driven by archaic underwriting policies on collateral, guarantor and long sanction timelines. This resulted in mushrooming of financing marketplaces that collaborated with multiple elders on their platform to lubricate the financing process.

Case in Point: Fintech platforms bring in flexibility and visibility for a student to see if his admit to the choice university is bank-fundable. GradRight’s AI algorithms allows a student to check financing ability at the stage of checking selected programs. This brings trust back into the system, because now students can integrate data into their decision making rather than completely relying on admission consultants who, well, might have conflicting incentives.

b. NBFC’s / Banks –

We expect to see higher competitive intensity in the financing space, as banks are doubling down on the opportunity. A three-way collaboration between study abroad consultants, NBFC’s/marketplaces and banks will ultimately result in cost advantage for the student, cost competitiveness for NBFC’s as they can leverage bank’s cost advantages and banks can leverage NBFC’s innovative underwrite practices based on student GPA, university / program’s employability metrics to further their bottom line.

GyanDhan, which is a popular study abroad loans marketplace now also has an NBFC licence which will allow it to lend from its own book. By our estimates, realisations can increase up to 3–4X.

4. Ancillary Services — Outside of these core areas, multiple businesses provide other ancillary support from visa and accommodation assistance, upskilling and job opportunities, alumni & community engagement.

Across the value chain, there continue to be significant opportunities to monetise students and add value, thereby increasing customer lifetime value.

Figure: Customer Lifetime Value Analysis for Study Abroad Services

With the era of the brain drain mindset long behind us, India now is becoming the talent exporter to the world. The study abroad ecosystem will play a key role in enabling talent transition to high-paying opportunities in foreign nations, along with providing them experiential and quality education. This sector continues to be an investor darling in a sector embroiled in trouble. High growth trajectory coupled with potential for integration and monetization across the value chain presents an opportunity worth looking at.