Pharma Newsletter (API & CRAMS)

The Indian API and CDMO sectors have been a hotbed of activity in the past fiscal, with a flurry of high-profile transactions taking place in the space. While sector is facing significant headwinds, such as pricing pressure and rising raw material costs, which are squeezing margins and driving smaller players out of the market, there are also tailwinds, such as the increasing degree of genericization and the adoption of a China+1 sourcing model, which are creating opportunities for growth. Against this backdrop, private equity firms have been active in creating integrated platforms to bring consolidation to this highly fragmented space.

In this article, we take a closer look at some of the key transactions in the API and CDMO sector, and offer our view on the future of the sector.

Headwinds

· Continued pricing pressure in key regulated markets such as the USA is driven by heightened competition across multiple therapeutic areas and a significant level of vertical integration, leading to a reduction in margins

· Uncertainty in the Geopolitical situation of Russia — Ukraine has the potential to disrupt Supply Chains resulting in critical drug shortages and RM supply disruption

· High inflation leading to rising Raw Material & KSM prices which is further eroding margins at an industry level which is driving smaller players out of the market

Tailwinds

· Supply Chain de-risking by global pharmaceutical players has led to the adoption of a China+1 sourcing model which has resulted in increasing demand for Indian API and intermediate players

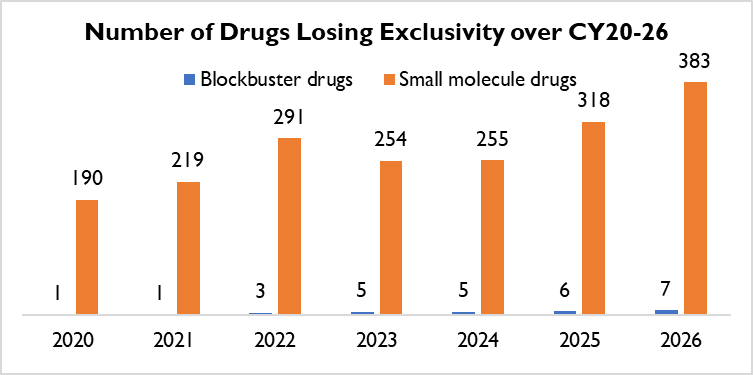

· Increasing degree of genericization ~950 small molecule drugs are set to lose exclusivity and go generic from 2024–2026 which opens up a significantly large market

Key themes in the CRAMS & API sector

· Increased PE deal activity in the Healthcare sector over the last 24 months with significant foreign capital flowing in — Large institutional investors both foreign and domestic have taken a keen interest in this space

· Increasing interest in the CDMO segment — higher margins and rapidly growing demand is driving high levels of CAPEX by existing players and entry of new players

· Despite high deal activity in the space, it continues to remain highly fragmented with over 2500 API and intermediate manufacturers in the country

· Outsourcing of Bulk Drug manufacturing will continue by larger global players and India is emerging as a preferred destination for CDMO with increasing contract awards and growing market size

· There have been structural shifts in competitiveness of Chinese firms — Stricter environmental norms coupled with increasing labour costs have directly increased cost of doing business leading to the moat becoming weaker with multiple firms in the Agro and API space perishing thus making the position of Indian players more competitive

Key Transactions in FY’23

· TA Associates acquired a significant stake in Synokem for $125Mn. Synokem is a CDMO player with exports to > 30 countries backed by strong R&D capabilities and robust manufacturing capabilities

· Advent acquired a majority stake (50.1%) in Suven Pharma with an intent to merge this into Cohance Lifesciences (owned and operated by Advent) with an aim to make it India’s leading CDMO platform. This deal was at a relatively premium valuation of EV/EBITDA ~21.8x

· Gland Pharma acquired 100% stake in Cenexi at a valuation of ~$ 130 Mn with an intent to enter the European CDMO market. Cenexi is a France based CDMO player with expertise in sterile liquid and lyophilized fill-finish drugs

· Florintree acquired an ~80% stake in Accutest Global for ~$13M. Accutest is a leading Clinical Research Organization operating in the pharmaceutical services space and generating > 50% of revenues from exports

· Everstone capital acquired a controlling stake in Softgel Healthcare which is a formulation CMO having 8 manufacturing facilities covering various dosage forms with >80% revenues from exports and a focus on nutraceutical, pharmaceuticals and OTC segment

· InvAscent has invested ~$30Mn in Malladi drugs for a minority stake — this capital will enable faster new product development and capacity expansion across its 3 FDA approved facilities

· PAG led consortium of funds which owns and operates API platform Sekhment Pharmaventures has invested ~260Mn for a 74% stake in Optimus drugs to enable capacity expansion and new product development in APIs and advanced intermediates

API & CDMO Platforms

· Due to the high level of fragmentation in the API & CRAMS space in India, PE firms have operated in this space by creating integrated platforms which is an attempt to bring consolidation in the highly fragmented space and derive synergies by operating across multiple parts in the value chain through a common commercial platform

Our View on the Sector

· We believe that the dual side pressure is putting tremendous financial pressure on smaller players — the current market conditions will drive consolidation in the sector with smaller players getting acquired by platforms / larger corporates with an active M&A strategy

· There is potential for creation of another API / CDMO platform over the next 1–2 years which will drive further consolidation in the sector

· Valuation premium in this sector will be driven by a few key factors such as large-scale assets, niche chemistry capabilities and strong execution capabilities across R&D and Manufacturing with product-level cost competitiveness being key