Education has embraced the change that the global pandemic brought with it. As new technologies catalyzed the industry, a lot of industry practitioners started to question whether EdTech was going into a bubble. Push forward to March 2021; EdTech businesses are thriving, companies are consolidating, and new technologies continue to emerge.

EdTech businesses that emerged due to the pure need of the hour are now being considered to be an integral part of the education system, as government policies and enhanced infrastructure are fueling the adoption of technology in education.

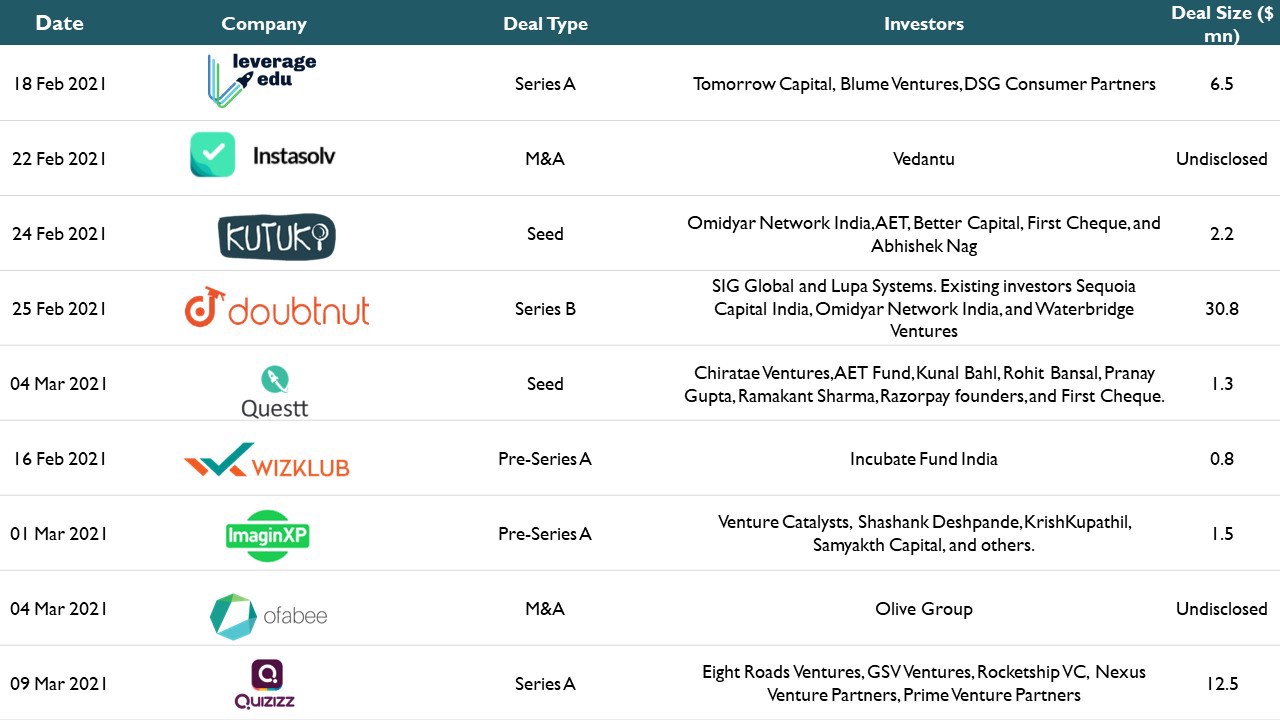

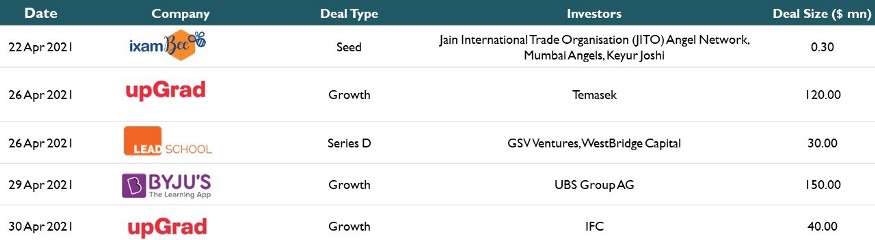

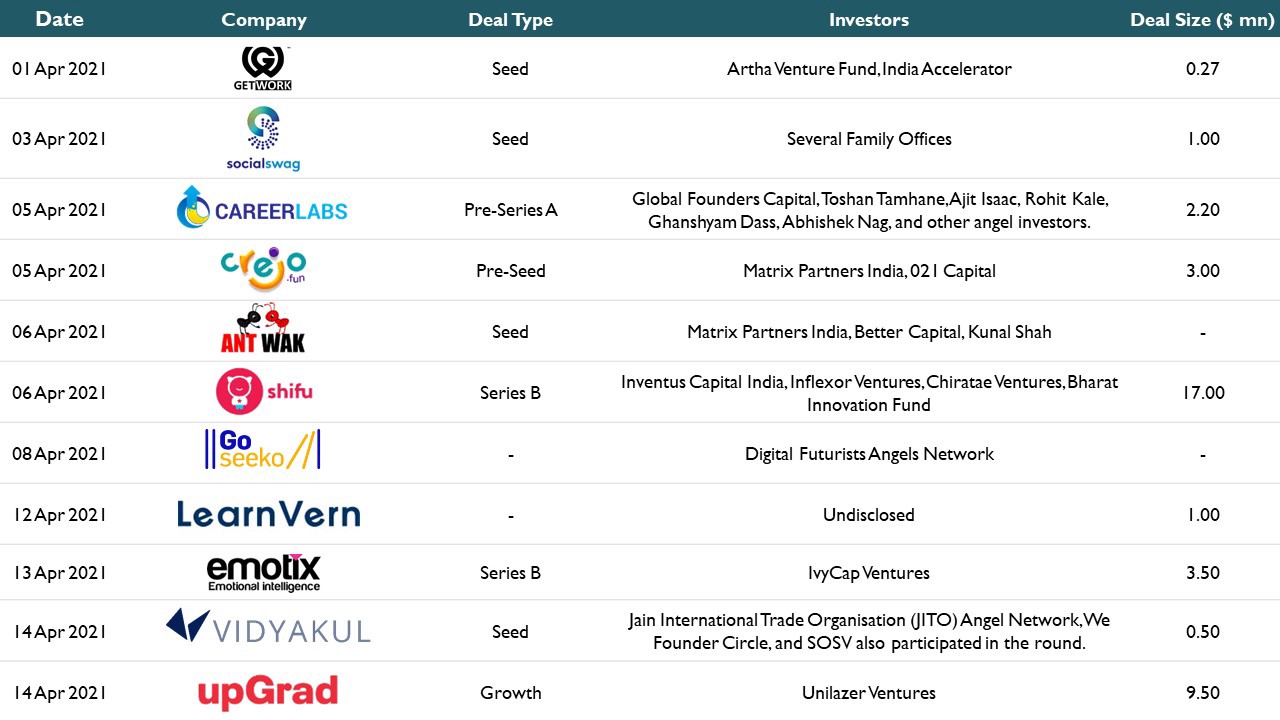

Between February 08, 2021 and March 13, 2021, India Inc. saw businesses in the K-12 space and their theses being validated by investors across the board. Seven companies raised capital and two were acquired. While the acquisition values were undisclosed, the capital raise equaled $55.6 million. Companies in K-12 raised close to $46.3 million, Higher Education raised about $8.8 million, and Assessment Platforms raised about $1.3 million.

Who Got A Slice?

- Leverage Edu (Series A, $6.5 million): Leverage Edu has a platform of over 2,500 personalized mentors and global universities, which helps students through their higher education application process. The round was led by Tomorrow Capital. Existing investors Blume Ventures and DSG Consumer Partners also participated in the round.

- Instasolv (M&A, Undisclosed): Instasolv uses AI and ML to simply scan vernacular questions and receive instant step-by-step solutions. Vedantu acquired Instasolv to strengthen its footing in the doubt solving domain. In June 2020, Instasolv had raised $2 million in a Pre-Series A funding from Vedantu with full rights to acquisition.

Instasolv has about 1 million users, who will now navigate to Vedantu’s platform. Doubt solving is synonymous with K-12 and Test Prep, places where Vedantu primarily operates. - Kutuki (Seed, $2.2 million): Founded in 2019, Kutuki is an interactive learning app that uses proprietary story and rhyme-based curriculum to teach language, numeracy, life skills, STEM, and general knowledge. Omidyar Network led the round, with participation from AET, Better Capital, First Cheque, and Abhishek Nag.

The fun bit about Kutuki is that they use Indian characters (i) Kutu (a boy), (ii) Ki (a girl), and (iii) Minku (Kutu and Ki’s elephant best friend). While other companies use anglicized cartoons, Kutuki’s India focus might just help it reach Tier-2/3 cities better, which is exactly what its funding is for, along with becoming a multi-vernacular company. - Doubtnut (Series B, $30.8 million): Founded in 2017, Doubtnut is a multi-lingual doubt-solving platform that uses AI/ML/MLP, and proprietary algorithms to provide video-based solutions. SIG Global and Lupa Systems led the round, with participation from Sequoia Capital India, Omidyar Network India, and Waterbridge Ventures.

After shutting deal talks with Byju’s over valuation, Doubtnut now plans to use this funding to expand to Tier-2/3 cities with a vernacular play, like other players. However, the question now becomes this. Would a platform like Doubtnut face challenges competing with a platform such as Vedantu who has acquired Instasolv, and naturally has a much larger user base (and capital)? - Questt (Seed, $1.3 million): Questt is an app that allows teachers to assign objective & subjective homework by choosing from a question bank. The round was led by Chiratae Ventures and AET Fund. Other investors included Kunal Bahl, Rohit Bansal, Pranay Gupta, Ramakant Sharma, Razorpay founders, and First Cheque.

Questt solves for the discrepancy in assigning and accepting homework through WhatsApp, Questt users (teachers) can assign homework in a very short amount of time and almost 80% of the homework is auto-evaluated. - WizKlub (Pre-Series A, $800K): WizKlub is a platform for developing skills for kids aged 5–15, through its Higher Order Thinking Skills (HOTS) programme. The platform aims to teach kids to develop the skillset to create tech products using coding, robotics, smart devices, and AI. Existing investor Incubate Fund India participated in the round.

- ImaginXP (Pre-Series A, $1.5 million): Founded in 2013, ImaginXP provides B.Des (Bachelor of Design), M.Des (Master of Design), BBA, MBA, BSc, and BTech degree programmes in partnership with universities. ImaginXP’s partner universities includes the likes of Chitkara University, Jagannath University, DIT University, Mody University, and Sushant University. Venture Catalysts led the round with participation from Shashank Deshpande, KrishKupathil, Samyakth Capital, and others.

The differentiating factor about ImaginXP is that it is not just a platform to bridge students and universities. ImaginXP partners with universities and gives them access to mentors and curriculum of new-age courses, to allow the universities to deliver these programmes. - Ofabee (M&A, Undisclosed): Ofabee enables tutors and coaching institutes to launch their own apps and websites, and sell courses to students globally. Ireland’s Olive Group acquired the company to merge it with its platform Mykademy, which hopes to enter the Indian market with this acquisition.

Mykademy expects this to be the first of the five acquisitions they plan to make this year. It will be interesting to see if the company makes further acquisitions to enter different segments of the Indian EdTech space. - Quizizz (Series A, $12.5 million): Quizizz helps teachers quickly create gamified quizzes and interactive lessons. Founded in 2015, the company focuses on teacher-directed learning, and is used in over 65% of schools in the US. Eight Roads Ventures led the round, with participation from GSV Ventures, Rocketship VC, Nexus Venture Partners, and Prime Venture Partners.

Quizziz expanded its product offering in 2020, after receiving feedback from its customers. The platform now supports over 60 million people a month, with customers in over 100 countries, and most importantly, its profitable. This is a perfect example of validated learning for startups.

Globally, companies which received funding included (i) Avion School (Coding Bootcamp, Income Share Agreement), (ii) KOCO (Digital Library for Assignments, Worksheets, and Assessments), (iii) Fenbi Education (Vocational Education Content), (iv) Class Technologies (Digital Learning Infrastructure), (v) ErudiFi (Education Financing), (vi) Preply (Tutor Marketplace), (vii) SplashLearn (K-12 Online Learning), (viii) Descomplica (K-12 courses), and (ix) Noesis Learning (Upskilling / Reskilling).

In the brick & mortar space, we saw acquisitions of education real estate provider Parmaco by Partners Group and school operator Horizon English School, Dubai by Cognita.

What’s Next?

Years ago, when EdTech had just begun its rise into India’s dark horse, it was solving a lot of surface level problems with companies such as Byju’s helping K-12 students learn faster and more efficiently.

The next wave of EdTech companies will be those which solve grassroot level problems. Look out for companies in the multi-vernacular (Kutuki, Pariksha), teacher-oriented products (Questt), and local-education empowerment (ImaginXP) spaces.

Note: We are not forgetting about Toppr’s multi-million dollar acquisition by Byju’s. We will talk about distress situations, and industry consolidation. But more on that, later.

As India’s trump card EdTech starts this year on a high note, we will end this article by introducing you to India’s next best teachers.

Watch this space for more on Education, EdTech, and everything in between.